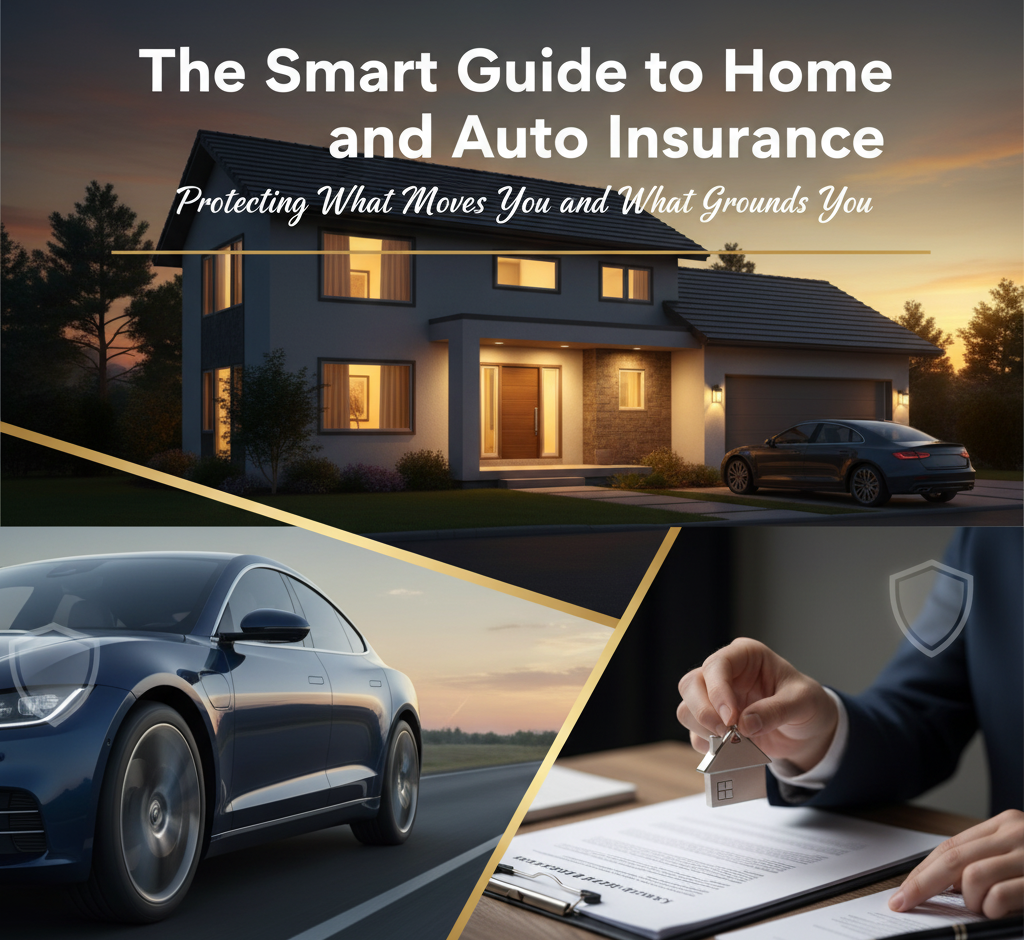

The Smart Guide to Home and Auto Insurance Protecting What Moves You and What Grounds You

The Smart Guide to Home and Auto Insurance Protecting What Moves You and What Grounds You

The Smart Guide to Home and Auto Insurance Protecting What Moves You and What Grounds You

Why Home and Auto Insurance Matter More Than Ever

Life moves fast — your car races through daily commutes, your home shelters dreams, laughter, and maybe the occasional spilled coffee. But one slip on an icy road or a surprise roof leak can turn everything upside down.

That’s where home and auto insurance come in — not as “just another bill,” but as a financial safety net that quietly protects your peace of mind.

“Insurance isn’t about predicting disasters — it’s about preparing for the unexpected.”

What Is Auto Insurance (And Why You Can’t Skip It)

Think of auto insurance as your personal pit crew. When the unexpected happens, it keeps your finances from crashing harder than your bumper.

Here’s what standard auto insurance typically covers:

-

Liability Coverage: Pays for damage or injuries you cause to others.

-

Collision Coverage: Handles repairs to your car after an accident.

-

Comprehensive Coverage: Covers non-collision damages — like theft, vandalism, or that mysterious shopping cart dent.

-

Uninsured/Underinsured Motorist Coverage: Because not everyone on the road plays by the rules.

Home Insurance: More Than Just Four Walls

Your house isn’t just a building — it’s your story. From the framed photos on the wall to the cozy couch where you binge-watch your favorite shows, everything inside has value.

A standard homeowner’s policy usually covers:

-

Dwelling Protection: For structural damage (fire, storms, falling trees — the works).

-

Personal Property: Protects your belongings from theft or damage.

-

Liability Coverage: Helps if someone gets injured on your property.

-

Additional Living Expenses (ALE): Covers costs if you need temporary housing after a covered event.

“Insurance can’t replace memories, but it can rebuild your world.”

Why Combine Home and Auto Insurance?

When you bundle home and auto insurance, you’re not just saving money — you’re simplifying life. One provider, one renewal date, one payment.

Top benefits include:

-

Discounts galore: Fewer policies, lower rates.

-

Simplified billing: One invoice for both policies.

-

Peace of mind: Consistent protection under one roof (and one hood).

How to Choose the Right Insurance Policy

Picking an insurance policy doesn’t have to feel like decoding an alien language. Here’s a quick checklist:

Compare quotes from at least three insurers.

Review coverage limits — cheap isn’t always better.

Check customer reviews and claims satisfaction.

Ask about extras like roadside assistance or identity theft protection.

“Your best policy is one that fits your lifestyle, not just your budget.”

Insurance: Smarter, Simpler, Digital

The insurance industry isn’t stuck in the past — it’s evolving. With AI-based risk analysis, usage-based car insurance, and digital claim tracking, it’s becoming more personalized and transparent than ever.

Final Thoughts

At the end of the day, home and auto insurance aren’t about fear — they’re about freedom. Freedom to drive with confidence. Freedom to sleep soundly under your own roof.